Contents

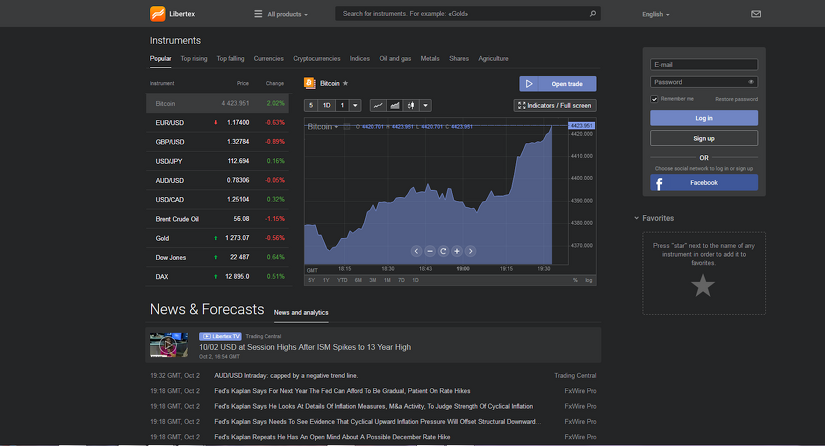

Line charts are used to identify big-picture trends for a currency. They are the most basic and common type of chart used by forex traders. They display the closing trading price for the currency for the time periods specified by the user. The trend lines identified in a line chart can be used to devise trading strategies. For example, you can use the information contained in a trend line to identify breakouts or a change in trend for rising or declining prices.

The day of the month that a country shifts to/from DST also varies, confusing us even more. Even though trading starts in New Zealand, it’s still called the Sydney session. The International Dateline is where, by tradition, the new calendar day starts. Most market activity will occur when one of these three markets open. The Forex Market Time Zone Converter displays which trading session is open in your current local time.

How much money do you need to be a forex trader?

The Best Minimum Deposit to Start Forex Trading In General

Starting with a minimum deposit of $100 will allow most traders to open positions on leverage without incurring too much risk as they steadily grow their portfolio.

This also includes their economic stability , interest and inflation rates, production of goods and services, and balance of payments. Alternatively, you can open a demo account to experience our award-winning platform and develop your forex trading skills. A key advantage of spot forex is the ability to open a position on leverage. Leverage allows you to increase your exposure to a financial market without having to commit as much capital.

Forex Market Hours

During the 1920s, the Kleinwort family were known as the leaders of the foreign exchange market, while Japheth, Montagu & Co. and Seligman still warrant recognition as significant FX traders. By 1928, Forex trade was integral to the financial functioning of the city. Continental exchange controls, plus other factors in Europe and Latin America, hampered any attempt at wholesale prosperity from trade for those of 1930s London. At the end of 1913, nearly half of the world’s foreign exchange was conducted using the pound sterling. The number of foreign banks operating within the boundaries of London increased from 3 in 1860, to 71 in 1913.

Traders can also use trading strategies based on technical analysis, such as breakout and moving average, to fine-tune their approach to trading. In addition to forwards and futures, options contracts are also traded on certain currency pairs. Forex options give holders the right, but not the obligation, to enter into a forex trade at a future date and for a pre-set exchange rate, before the option expires. The cost of trading forex depends on which currency pairs you choose to buy or sell.

FOREX.com may, from time to time, offer payment processing services with respect to card deposits through StoneX Financial Ltd, Moor House First Floor, 120 London Wall, London, EC2Y 5ET. I’d like to view FOREX.com’s products and services that are most suitable to meet my trading needs. Choose from standard, commissions, or DMA to get the right pricing model to fit your trading style and strategy. Join our analysts for a 60-minute webinar during the release of the US Non-Farm Payroll report for instant analysis of the numbers and what they may mean for the markets. Intuitive and packed with tools and features, trade on the go with one-swipe trading, TradingView chartsand create custom watchlists. Winner of the 2021 award for Best Forex Platform and the 2020 award for Best Forex Trading Platform.

A joint venture of the Chicago Mercantile Exchange and Reuters, called Fxmarketspace opened in 2007 and aspired but failed to the role of a central market clearing mechanism. It is estimated that in the UK, 14% of currency transfers/payments are made via Foreign Exchange Companies. These companies’ selling point is usually that they will offer better exchange rates or cheaper payments than the customer’s bank. These companies differ from Money Transfer/Remittance Companies in that they generally offer higher-value services.

In some countries, the black market fallout of exchange rates management has assumed a troubling dimension. In most cases, there is a wide disparity between the official and autonomous FX rates. Electronic Broking Services and Reuters are the largest vendors of quote screen monitors used in trading currencies.

Starting with how currency trading works, plus how to open your first position. Not every currency is traded all day every day, even with the market being open throughout the week. Monitor live forex spreads of the most traded currency pairs to watch the market. The most commonly traded currency pairs fit into a group called ‘majors’, what is a pin bar while currency pairs outside that group can fall into the ‘minors’ and ‘exotics’ groups. The only thing is, when you trade on the forex market, you are making a similar transaction without the need of travelling. Forex traders are opening these position from home, or anywhere in the world, by using a forex trading account.

Futures are standardized forward contracts and are usually traded on an exchange created for this purpose. Prior to the First World War, there was a much more limited control of international trade. Motivated by the onset of war, countries abandoned the gold standard monetary system. The information in this site does not contain investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority.

This can be done by combining thorough research and practising with a free demo account. Our guide on forex trading for beginners allows new traders to develop their skills. For this same reason, private investors and individual traders have entered the market and discovered several advantages – many of which are not available in other markets. The FX market is an over-the-counter market in which prices are quoted by FX brokers (broker-dealers) and transactions are negotiated directly with the buyers and sellers .

Why Trade Forex with AvaTrade?

At the start of the 20th century, trades in currencies was most active in Paris, New York City and Berlin; Britain remained largely uninvolved until 1914. Between 1919 and 1922, the number of foreign exchange brokers in London increased to 17; and in 1924, there were 40 firms operating for the purposes of exchange. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.

Because there are such large trade flows within the system, it is difficult for rogue traders to influence the price of a currency. This system helps create transparency in the market for investors with access to interbank dealing. The possibility of earning a good day-to-day living attracts many people to the Forex markets. The high volume of trading in the Forex markets makes for a very liquid market where bid-ask spreadsare attractively low. Rates shown are expressed in ‘points’, where 1.0 point is equal to one tenth of 1 Pip.

The currency forwards and futures markets can offer protection against risk when trading currencies. Usually, big international corporations use these markets to hedge against future exchange rate fluctuations, but speculators take part in these markets as well. 73% of retail investor accounts lose money when trading CFDs with this provider.

After the Bretton Woodsaccord began to collapse in 1971, more currencies were allowed to float freely against one another. The values of individual currencies vary based on demand and circulation and are monitored by foreign exchange trading services. It is also a good idea to find out what kind of account protections are available in case of a market crisis, or if a dealer becomes insolvent. The foreign exchange market – also known as forex or FX – is the world’s most traded market. To start trading forex with Charles Schwab Futures and Forex LLC, you’ll need to open astandard account. You will also need to apply for, and be approved for, margin privileges in your account.

Because so much of currency trading focuses on speculation or hedging, it’s important for traders to be up to speed on the dynamics that could cause sharp spikes in currencies. Instead of executing a trade now, forex traders can also enter into a binding contract with another trader and lock in an exchange rate for an agreed upon amount of currency on a future date. Most forex trades aren’t made for the purpose of exchanging currencies but rather to speculate about future price movements, much like you would with stock trading.

Investing in over-the-counter derivatives carries significant risks and is not suitable for all investors. ‘Forex’ or ‘FX’ is short for foreign exchange, while ‘forex trading’ refers to the act of trading on the foreign exchange market. Forex scalping is where traders hold multiple short-term trades and build profit based on small but frequent winning trades. This strategy may be best suited to traders who can commit a large proportion of their time to trading, and are more focused on technical analysis.

Trade CFDs on 23 popular cryptocurrencies including Bitcoin, Ethereum, and Ripple

The FX traded in the black market is referred to as “free funds”—compared with “official funds” that depicts FX traded in the interbank market. Many commercial banking customers—especially the traders—do most of their import transactions with free funds. In reference here is FX procured outside sales by the Central Bank in countries that have administered foreign exchange policies. The risk management implication is that banks should adhere strictly to FX regulations and endeavor to operate within regulatory requirements and guidelines at all times. Critical issues often border on documentation, disclosure, and reporting requirements for FX sources and transactions. Because governments, corporates and private individual who require currency exchange services are spread around the world, so trading on the forex market never stops.

Why is forex so hard?

Maximum Leverage

The reason many forex traders fail is that they are undercapitalized in relation to the size of the trades they make. It is either greed or the prospect of controlling vast amounts of money with only a small amount of capital that coerces forex traders to take on such huge and fragile financial risk.

The forex market is more decentralized than traditional stock or bond markets. There is no centralized exchange that dominates currency trade operations, and the potential for manipulation—through insider information about a company or stock—is lower. Automation of forex markets lends itself well to rapid execution of trading strategies. Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50.

It is the only truly continuous and nonstop trading market in the world. In the past, the forex market was dominated by institutional firms and large banks, which acted on behalf of clients. But it has become more retail-oriented in recent years, and traders and investors of many holding sizes have begun participating in it. James Chen, CMT is an expert trader, investment adviser, and global market strategist. There are only a handful of major currency pairs that a trader needs to familiarise themselves with.

How many hours of trading per day do you need to make money in forex?

Swing trading forex may be best suited to traders who prefer a balance between fundamental and technical analysis. Positions are open for several days, with the aim to buy at ‘swing lows’ and sell at ‘swing highs’, or vice versa if going short. Less time is spent analysing market trends in this method over some others, and there will be overnight holding costs and more chance of the market ‘gapping’. You can open a live or demo account to trade on price movements of forex pairs. When trading forex, as well as any other instrument, you must be able to trade with confidence. Profits can never be guaranteed, and any type of trading has its advantages and disadvantages, as well as the risk of losing funds.

And EUR/USD will experience a higher trading volume when both London and New York sessions are open. Just because you can trade the market any time of the day or night doesn’t necessarily mean that you should. Large hedge funds and other well capitalized “position traders” are the main professional speculators. According to some economists, individual traders could act as “noise traders” and have a more williams fractal destabilizing role than larger and better informed actors. Currency and exchange were important elements of trade in the ancient world, enabling people to buy and sell items like food, pottery, and raw materials. If a Greek coin held more gold than an Egyptian coin due to its size or content, then a merchant could barter fewer Greek gold coins for more Egyptian ones, or for more material goods.

Who controls the forex market?

7.1 The Foreign Exchange Market

It is decentralized in a sense that no one single authority, such as an international agency or government, controls it. The major players in the market are governments (usually through their central banks) and commercial banks.

These are caused by changes in gross domestic product growth, inflation , interest rates , budget and trade deficits or surpluses, large cross-border M&A deals and other macroeconomic conditions. Major news is released publicly, often on scheduled dates, so many people have access to the same news at the same time. However, large banks have an important advantage; they can see their customers’ order flow.

Foreign exchange market

Within the interbank market, spreads, which are the difference between the bid and ask prices, are razor sharp and not known to players outside the inner circle. The difference between the bid and ask prices widens (for example from 0 to 1 pip to 1–2 pips for currencies such as the EUR) as you go down the levels of access. If a trader can guarantee large numbers of transactions for large amounts, they can demand a smaller difference between the bid and ask price, which is referred to as a better spread.

The currency on the left is called the base currency, and is the one we wish to buy or sell; the one on the right is thesecondary currency, and is the one we use to make the transaction. Each pair has two prices – the price for selling the base currency and a price for buying it . The difference between them is called aspread, and represents the amount brokers charge to open the position.

AUDUSD has been trading in a down trend, the price is trading at the trend line where the market expect bears to show up. More conservative play of this setup is to wait for the lows to be taken first then jump on the retest of the highs. Currencies are divided into two main categories – Major currencies and Minors. The major currencies are derived from the most powerful economies around the globe – the US, Japan, the UK, the Eurozone, Canada, Australia, Switzerland and New Zealand. For instance, the GBP against the USD becomes GBP/USD where one’s value is relative to the other.

For most currency pairs, a pip is the fourth decimal place, the main exception being the Japanese Yen where a pip is the second decimal place. Discover the account that’s right for you by visiting our account page. If you’re new to forex, you can begin exploring the markets by trading on our demo account, risk-free. Forex is short for foreign exchange – the transaction of changing one currency into another currency.

As a result, currencies tend to reflect the reported economic health of the country or region that they represent. Like most financial markets, forex is primarily driven by the forces of supply and demand, and it is important to gain an understanding of the influences that drive these factors. This means that leverage can magnify your profits, but it also brings the risk cryptocurrency brokerage firm of amplified losses – including losses that can exceed your initial deposit. Leveraged trading, therefore, makes it extremely important to learn how to manage your risk. That means when you buy one currency, you do so by selling another. An award winning and leading provider of online foreign exchange trading, stocks, CFD trading, Crypto and related services worldwide.

Frequently Asked Questions about Forex Market Hours

Brown & Sons traded foreign currencies around 1850 and was a leading currency trader in the USA. Do Espírito Santo de Silva (Banco Espírito Santo) applied for and was given permission to engage in a foreign exchange trading business. Gaps do occur in the forex market, but they are significantly less common than in other markets because it is traded 24 hours a day, five days a week. The most commonly traded are derived from minor currency pairs and can be less liquid than major currency pairs.

Forex trading is the means through which one currency is changed into another. When trading forex, you are always trading a currency pair – selling one currency while simultaneously buying another. Gaps in forex trading are when a market moves from one price to another without any trading in between. They occur most often over the weekend – a market may close at one price on Friday, then open higher or lower the following Monday. In 2019, there was $6 trillion of forex traded on average each day according to the Bank for International Settlements.