EXAMPLE: How applying NPV and IRR concepts can help you make money with your real estate investments.

The investment property and refinance calculators make use of the concept of net present value. The basic idea is that a dollar today is worth more than a dollar tomorrow.

- If you were to invest $100,000 today at 1%, you would end up with $101,000 after one year.

- The present value of that future $101,000 is equal to $101,000/1.01 = $100,000.

To calculate present value (PV), use:

![]()

Where:

FV = future value

r = annual rate of return

n = number of periods

To calculate your mortgage payment (PMT), use:

![]()

Where:

P = Loan amount

i = monthly mortgage rate = annual mortgage rate/12 months

n = number of months = number of years x 12 months

If you do not consider the present value of an investment or refinance opportunity, you may think you are saving money when you are actually losing money.

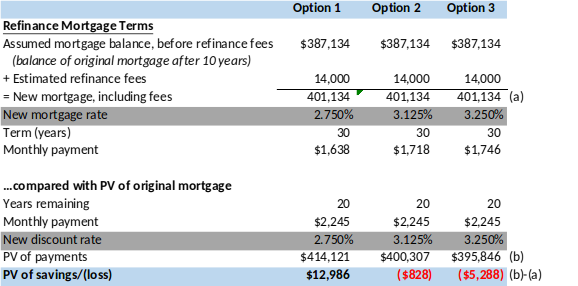

Consider the refinance scenarios below:

Let’s assume that after ten years, you decide to refinance. You have three options:

Note that the discount rate used to calculate the PV is the NEW mortgage rate. As you can now effectively borrow money at a lower cost, we use the new, lower discount rate.

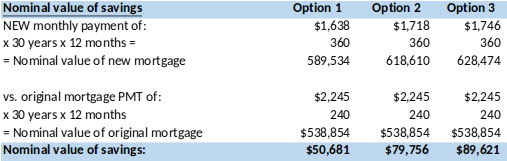

While the nominal value of savings suggests that all three refinance options make sense, the PV calculations show that only Option 1 makes sense. You will actually lose money on a PV basis refinancing under Options 2 or 3.

A refinance under Option 1 has a nominal savings of $50,681, while the actual present value is only $12,986. If you have additional mortgage broker and bank fees of $15,000 (not uncommon), you would actually be losing money even on Option 1.

Copyrights 2022 all rights are reserved. Disclaimer Terms and conditions Privacy policy